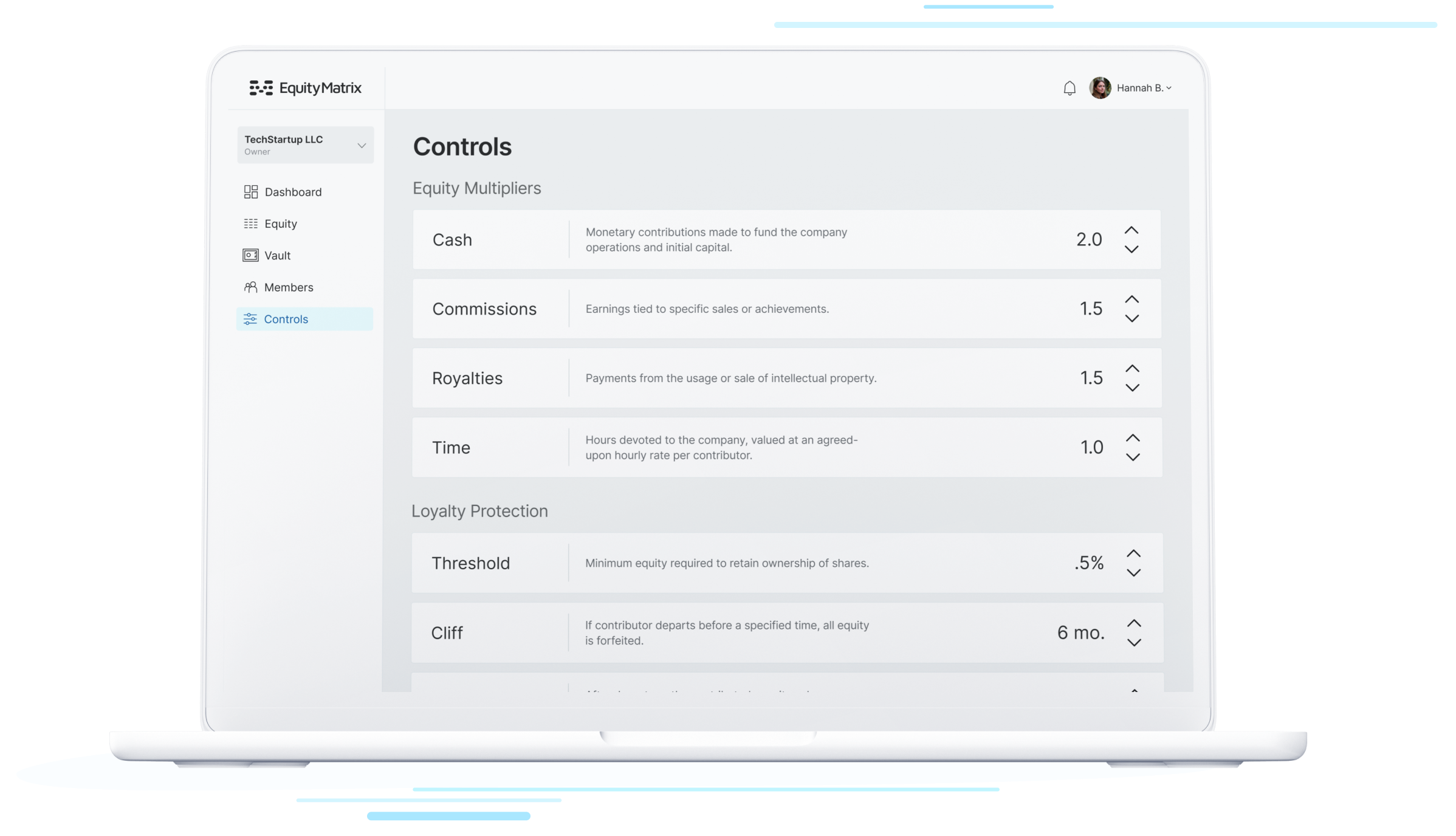

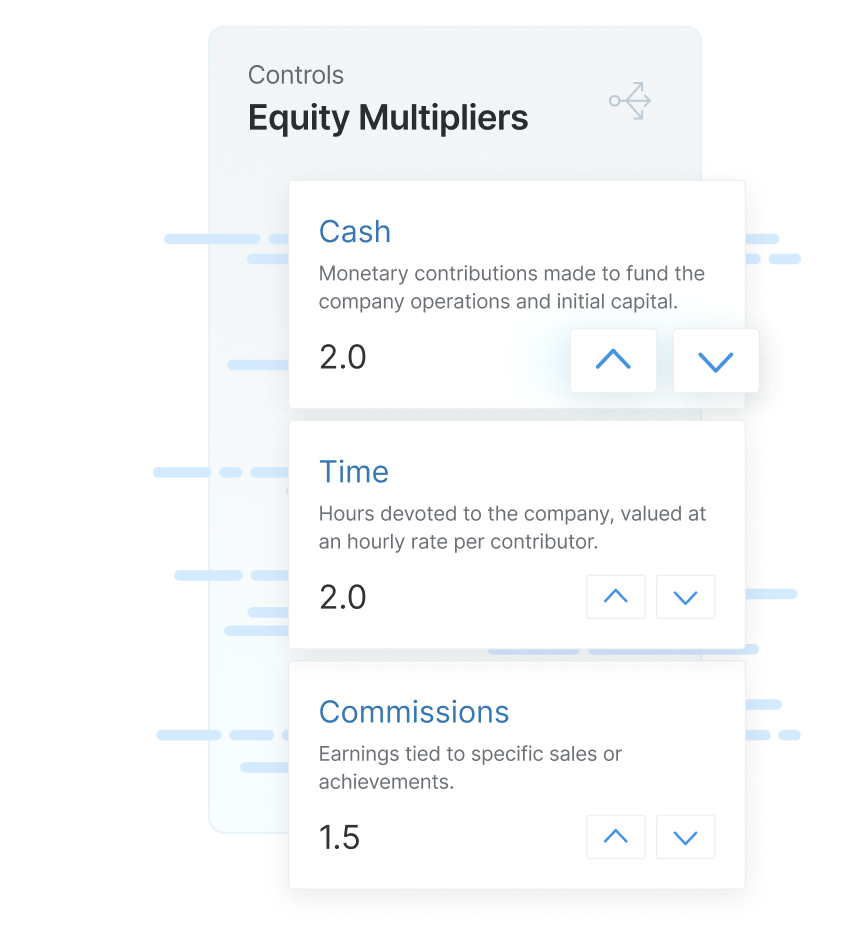

Fine-tune how equity is earned.

Set different equity weights for time, cash, IP, or commissions to reflect what matters most to your company.

It feels easy to say “let’s just split it 50/50.” But startups aren’t static. Over time, one founder may put in more hours, invest more money, bring in key deals — or leave the company entirely.

When ownership no longer matches real contributions, conflict is inevitable.

That’s why 65% of startups fail due to founder disputes.*

Don’t let yours be one of them.

“A startup team with unequal equity splits is three times more likely to experience serious conflict.”

Equity Matrix gives your team a transparent, adaptable system for earning equity based on contributions over time.

Whether it’s cash, time, IP, or sales, every contribution can be tracked, measured, and reflected in ownership.

No more one-time splits. No more resentment. Just a clear path to fair, lasting equity alignment.

“Co-founder conflict is often a bigger threat than product failure.”

A way better and fair way to allocate equity. Using this approach has completely changed how we work together by alleviating tension and reducing conflict.

Set different equity weights for time, cash, IP, or commissions to reflect what matters most to your company.

“The equity split conversation is the first test of the cofounder relationship.”

All data is encrypted in transit and at rest, stored securely using industry best practices.

We’re GDPR-compliant and built with privacy-first principles—because trust starts with protection.

If you decide to raise venture capital, you can “freeze” your Equity Matrix at any point and convert it into a traditional fixed cap table. This locks in everyone’s ownership percentages based on their approved contributions to date, giving investors the structure they expect while preserving the fairness you’ve built along the way.

Equity Matrix works just as well for small side projects as it does for full‑scale startups. You can log contributions as you go — whether that’s a few hours a month, occasional expenses, or help from friends — and ownership adjusts automatically. If the project grows into something bigger, your equity splits will already reflect everyone’s real contributions from day one.

By default, Equity Matrix is designed for teams of up to 10 people. If your company has more than 10 members, reach out to us — we don’t see any issue with scaling, but right now we’re focused on perfecting the model for smaller teams before expanding.

Equity Matrix gives you full control over what happens when someone stops contributing. You can set loyalty rules — such as cliffs, minimum contribution thresholds, or equity decay — to determine whether they keep all, some, or none of their shares. If they’ve met your requirements, their ownership simply freezes at their current percentage while the rest of the pool continues to adjust for active members. If they haven’t met the cliff or threshold, their shares can be removed entirely. You also don’t pay for inactive users. Former members can be reactivated at any time, and they’ll simply count toward your plan’s active user limit when they return.

Yes. Equity Matrix works for any shared‑ownership project — not just tech startups. Whether you’re building a small business, launching a side hustle, or running a creative collaboration, the model adapts to track and reward contributions fairly. If you have a team working toward a shared goal and want ownership to reflect real effort, Equity Matrix is a fit.

Absolutely. Equity Matrix is built to handle the realities of small teams, whether you’re running a family business, a local service company, or a growing boutique brand. It ensures ownership matches actual contributions, so you can avoid awkward equity conversations and keep things fair as your business evolves. Our default setup is designed for teams of up to 10 people, making it ideal for most small businesses.

Not yet. Equity Matrix doesn’t currently support reserving equity for ideas, intellectual property, or other non‑tracked contributions — but it’s on our roadmap. We’d love to hear how you’d use this feature so we can shape it to fit real‑world needs.

Yes, according to Noam Wasserman, The Founder's Dilemma. He researched over 10,000 start-ups and found that 65% of high-potential startups fail due to interpersonal conflicts among founders. The research revealed that equity disputes are the leading cause of these conflicts. Wasserman's study showed that teams with unequal equity splits are three times more likely to experience serious conflict than those with equal splits. However, equal splits create their own problems when contributions become unequal over time—which happens in nearly every startup. The most common scenario: founders agree to a 50/50 split at the beginning when enthusiasm is high, but as the company evolves, one founder invests more time, money, or brings in key customers. When ownership doesn't reflect these contributions, resentment builds and conflicts emerge. This is why dynamic equity models like Equity Matrix exist—to prevent these conflicts by ensuring ownership percentages automatically adjust based on actual contributions, eliminating the primary source of founder disputes before they begin.